BITDASHU Story

If you have high-income friends around you, you can recommend them to use BitCoin mining as a wealth key, a digital gold key, for tax deduction and deferral. It’s simpler and more flexible than buying houses or investing in other businesses — unlike houses that must be sold as a whole and can’t be sold in parts; and it can be cashed out at any time for any amount of dollars or other currencies.

Here’s a true story of a “small miner”:

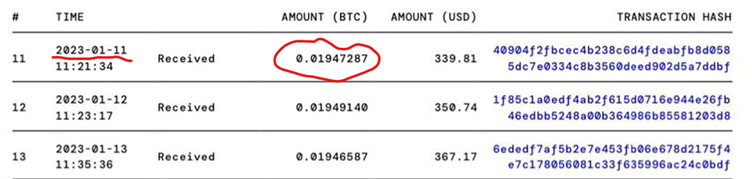

Before Christmas 2022, I relocated the 51 mining machines I had gradually purchased from Texas to a mining farm in Washington State. This batch of machines mainly consisted of 95T, with some 100T and 114T machines. At that time, there were fewer people mining, and with an average of 50 machines with 100T hashing power each, in early 2023, they were able to mine approximately 0.0193 Bitcoins per day. The dollar amount earned on that day was based on the bitcoin price of that particular day and is not worth referring to if you mine and hold.

If you only mine and do not sell, and assuming you sell at today’s (March 12, 2024) highest coin price of $73,000, your daily income would be:

0.0193 x $73,000 = $1,408.9

After deducting daily electricity expenses of around $280, your daily net income would be $1,129.

The total cost of this batch of machines at the time was $150,000. In 2023, a total of 4.55006425 bitcoins were mined. If sold at $73,000 each, the total revenue would be $332,155. Deducting one year’s electricity cost of $280 x 365 = $102,200, the net profit for 2023 would be $79,955.

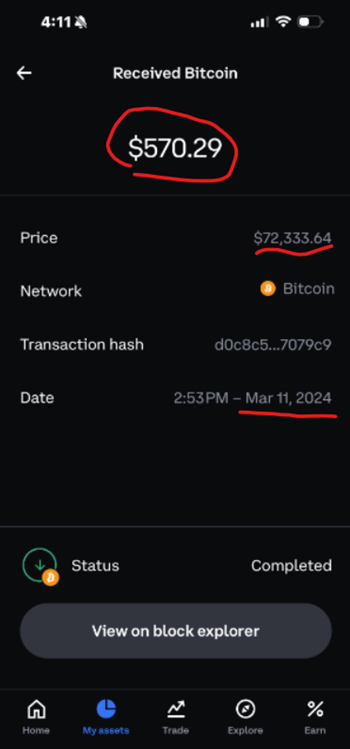

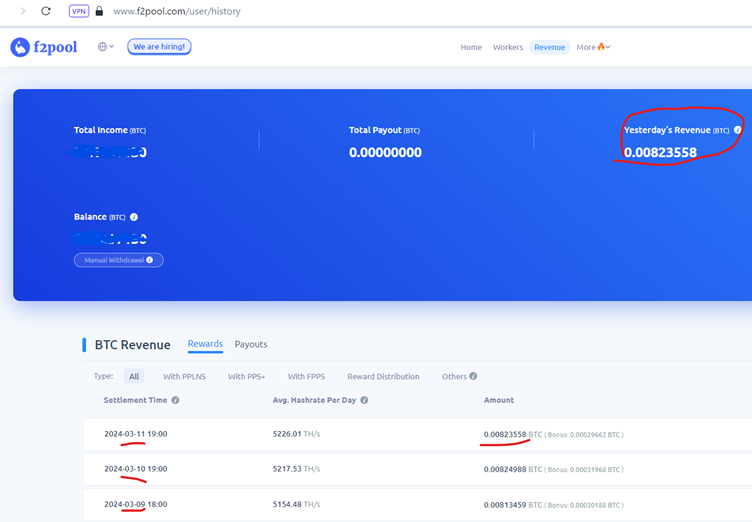

Yesterday (March 11, 2024), the amount of Bitcoin mined was equivalent to $570 based on the current day’s coin price. The electricity cost remains the same at $280. Therefore, the net daily income is $290. Since the capital for this batch of mining machines has already been recovered (we can consider the machine cost as $0), the $290 represents the daily net profit.

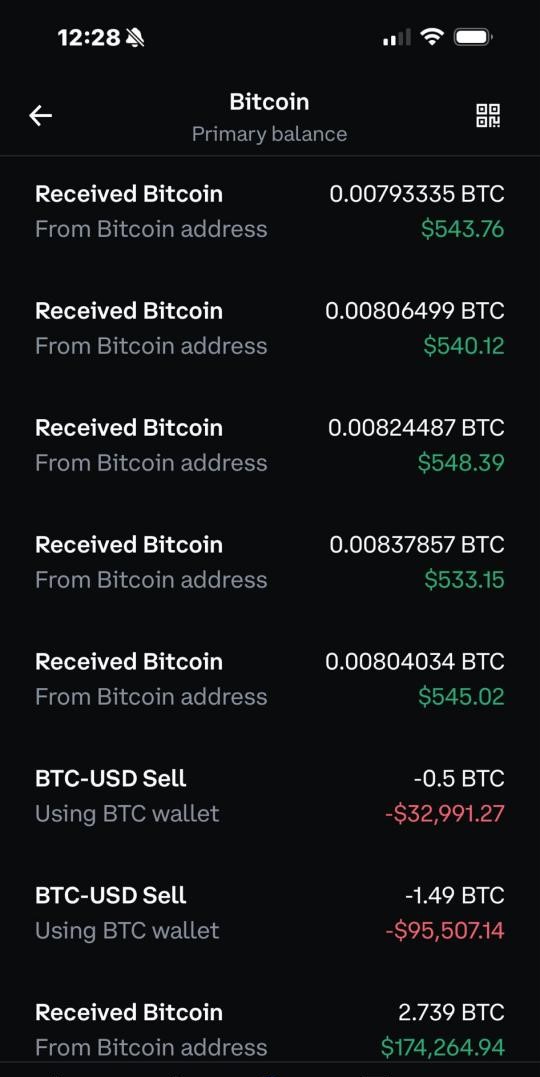

Here is the recent earnings. Mining is more reliable than any other business. You can see digital gold entering your wallet every day, which gives you peace of mind. The 2.739 bitcoins transferred into the record were moved from a cold wallet (offline wallet) to Coinbase’s hot wallet (online wallet: with risks of being hacked or platform misappropriation) for trading. The negative numbers in red represent the amount of USD obtained from selling bitcoins. I sold $128,000 worth and used it to purchase more mining machines, expanding the capacity of the money printer, reducing income tax, and increasing my digital gold assets. I spend $280 on electricity every day, which is equivalent to investing $280 worth of bitcoins daily, based on the cost of electricity of around $27,000. Since the coin price and the overall network hashing power change daily, I divide the total electricity costs paid in 2023 by the total number of bitcoins mined that year. The cost is about $24,000 a bitcoin. Currently, one bitcoin is mined approximately every 20 minutes, with the global network hashing power sharing it. My 50 machines account for a certain percentage of the network hashing power, and I receive a corresponding number of bitcoins. It used to be 0.0193 bitcoins per day, but now it’s 0.008. So, as a miner with income from other industries, I prefer the coin price not to be too high. It’s best if the coin price doesn’t cover the electricity expenses. Without other financial support, they would be forced to shut down which will be reducing the overall network hashing power. With the same 50

machines, I would receive more bitcoins, resulting in higher investment returns. These high-income miners never shut down their machines; the money printer is always running until the machines are completely worn out.

The second batch of 50 mining machines placed in the South American mining farm has a higher hashing power, consisting of 117T and 120T combinations, with an average hashing power of 118.5T. Therefore, they are expected to mine more coins. The first batch of 100T machines mined 0.0079, while these are expected to mine 0.0082. However, electricity prices in South America are much cheaper compared to the United States. For example, if electricity costs 7.5 cents per kWh in the US, it’s 6 cents in South America. But the political environment in South America is not as stable as in the US, and there may be threats from electricity extortionists, road bandits, and thieves. It’s up to you whether you’re willing to take the risk.

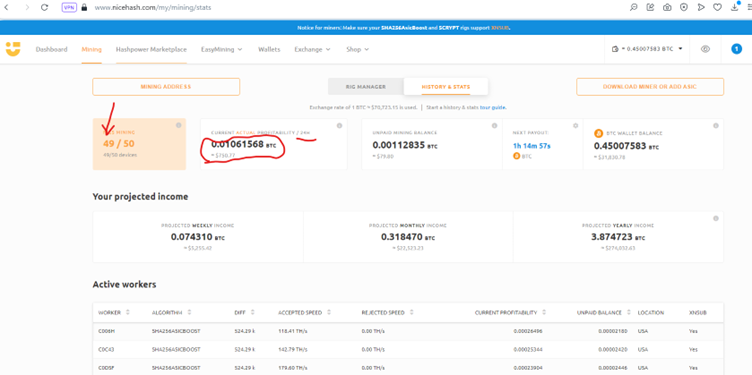

This is the third batch of 50 Kpro 120T mining machines that started to mine on January 25th of this year. These machines have better performance and consume less power despite having the same hashing power of 120T. Previously, the daily electricity cost for the 100T machines was $280, but now it’s only $250 for the 120T machines. With a daily mined amount of 0.01061568 bitcoin and a selling price of $73,000 per bitcoin, the net daily income is $525 after deducting the electricity cost. This is $235 more than the net daily income of $290 from the first batch of 50 machines. These machines are also cheaper, costing only $88,200 for 50 machines. With a net daily income of $525, it would take approximately 168 days (5.6 months) to recoup the investment. If you can wait until the coin price exceeds $80,000 or $100,000 before selling, the payback period will be even shorter!

The fourth batch I ordered is the S21, a newer mining machine with a hashing power of 188T. These machines are more expensive but consume less power. The electricity cost for these machines will be the same as the third batch of 120T machines, but with an increased hashing power of 68T. This batch is already on its way from Hong Kong to the United States and is expected to arrive next week. Once the mining facilities are set up, they should be operational by the end of the month. At that time, I will have real and actual data to share with everyone.